THERE IS NO CRYPTOS, THERE IS ONLY BITCOIN

Share

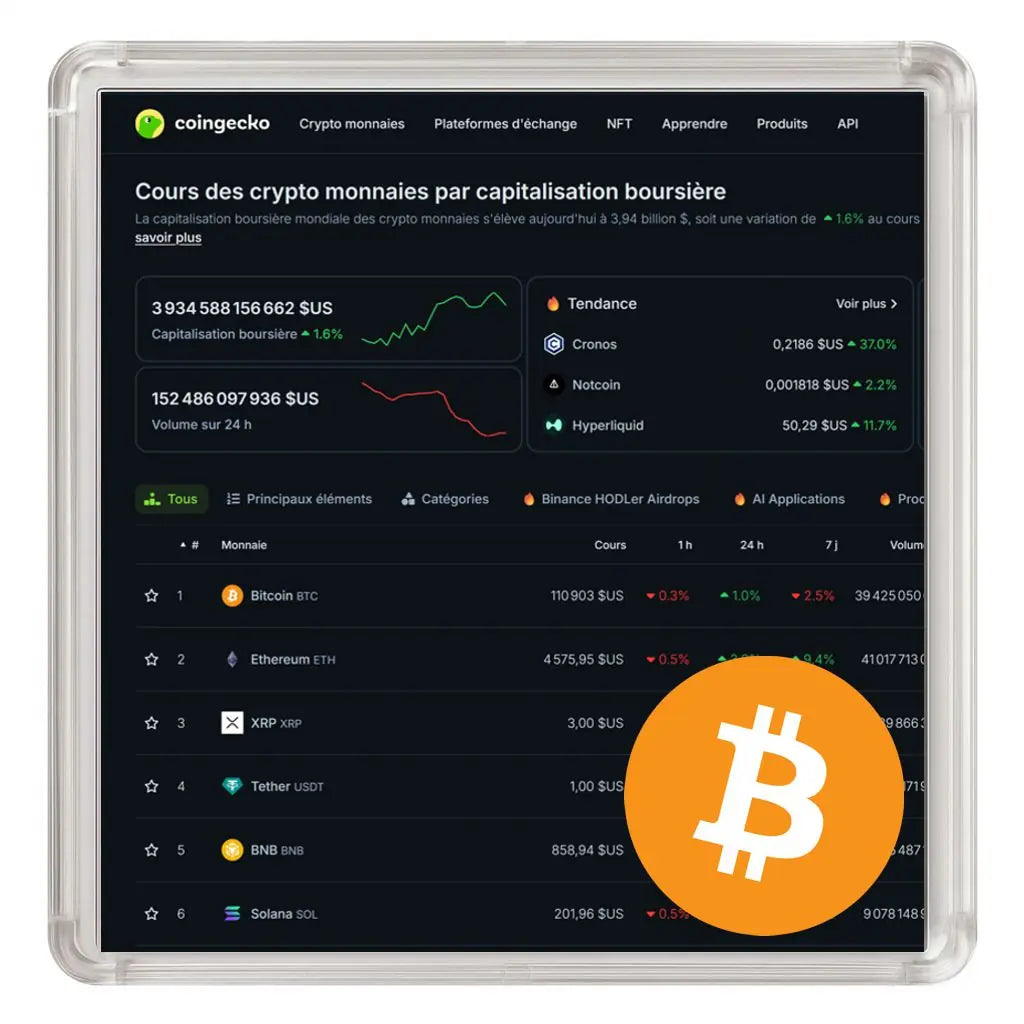

We constantly repeat this word like a verbal tic: “cryptos.” We lump everything together: Bitcoin and the hundred or so colorful tokens flooding the markets. As if the monetary invention of the century were just another line on CoinMarketCap. As if Satoshi Nakamoto had launched a simple speculative project among others, to be filed away among technological experiments, corporate tokens, and disguised stocks. This is a mistake. It's even more than that: it's a collective blindness.

Because the truth is simple: there are no cryptos, there is only Bitcoin.

Everything else, without exception, is just a derivative product. Variations more or less ingenious, more or less sincere, but always burdened by an original flaw: that of having a master, a conductor, a company that pilots them. Bitcoin, on the other hand, belongs to no one. It has no marketing plan, no centralized update, no official gateway. It is raw, like a diamond born under pressure.

To understand this gap, it's not enough to repeat it like a maximalist slogan. It must be demonstrated by comparing Bitcoin to the market behemoths, those that YouTubers like to line up in their videos: Ethereum, XRP, Binance Coin, Solana. The “challengers” of the top 5. And if we take the trouble to examine each of them, one by one, then the difference becomes glaring.

Bitcoin vs. Ethereum: Currency vs. World Computer

Ethereum was born in 2015, the brainchild of a young prodigy: Vitalik Buterin. The ambition was immense: to create a “world computer,” a decentralized platform capable of hosting any program, any contract, any application. Where Bitcoin was intended to be simple—a neutral and incorruptible currency—Ethereum wanted to be universal, programmable, and extensible. On paper, the promise was great. In reality, it has given birth to a febrile, shifting, and fragile ecosystem. Ethereum is not a currency: it is a platform for projects. Its unit of account, ether (ETH), is not designed to be a store of value but to pay for the fuel of smart contracts. It is a utilitarian resource, not a standard.

And above all, Ethereum has governance. A foundation. Developers who decide on updates, who orchestrate forks, who move the lines. The most glaring example was the hack of The DAO in 2016. Hundreds of millions evaporated because of a flaw in a contract. The network forked, undoing history, rewriting the chain. Bitcoin, on the other hand, has never erased its scars. History is irreversible. This is precisely what makes it an incorruptible currency. Then came “The Merge,” this transition to Proof of Stake, decided at the highest level. An internal revolution, imposed by technical governance. This fundamental change in consensus shifted Ethereum into a logic close to that of a private company that decides its strategic direction.

Bitcoin, however, has remained true to its path: Proof of Work, maximum decentralization, no compromises with slowness or energy expenditure. Because this expenditure is its security. This rigidity is its strength. Ethereum evolves, Bitcoin persists. Ethereum is a laboratory, Bitcoin is the standard.

Bitcoin vs. XRP: Sovereignty vs. Regulated Finance

XRP was born from the opposite ambition: instead of challenging the banking system, it wanted to integrate into it. Ripple Labs, the company behind XRP, has always assumed its role as a partner of financial institutions. The goal: to streamline international transfers, accelerate interbank settlements, and attract SWIFT and others. But XRP is centralized at the root. Almost all of the tokens have been pre-mined. The company still holds immense reserves, which it distributes according to its strategy. The supply didn't emerge naturally through mining, like Bitcoin. It was printed all at once, like a digital fiat currency.

And above all, XRP depends on the courts. Years of litigation against the US SEC have shown how vulnerable this project remains to political or judicial decision. Bitcoin, on the other hand, is out of reach. No jurisdiction can stop it. There are no Bitcoin companies to attack, no headquarters to raid, no CEOs to bring to trial.

The contrast is stark: Bitcoin is civil disobedience encoded in stone, XRP is an attempt at integration into the banking system. Bitcoin is escapism, XRP is submission.

Bitcoin vs. BNB: Open Source vs. Corporation

BNB is nothing mysterious: it's the in-house token of a private company, Binance. Its value is based on a marketing promise: platform users benefit from fee reductions by using it. Then burn programs were added to artificially maintain scarcity. Then DeFi applications were added to give the illusion of an ecosystem. But at its core, BNB is just a stock in disguise. Its survival depends entirely on the health of Binance. If the exchange shuts down tomorrow, the token collapses. If there's a regulatory scandal or a liquidity problem, everything goes up in smoke.

Bitcoin, on the other hand, depends on no one. Not on a company, not on a platform, not on a charismatic founder. Its resilience is total. Even if all the exchanges closed, even if all the states conspired to ban it, it would continue to run. As long as there is a single miner, a single node, a single user, Bitcoin can breathe.

BNB is a brand. Bitcoin is a truth.

Bitcoin vs. Solana: Robustness vs. Speed

Solana is the darling of traders. Fast, fluid, capable of processing thousands of transactions per second. The argument is compelling: where Bitcoin seems slow and frugal, Solana boasts rocket-like performance. But this speed comes at a price: centralization. The number of validators is limited, hardware barriers are high, and redundancy is fragile. The network has already experienced several massive outages, where the entire blockchain ceased to function. Can we imagine a global currency that shuts down and restarts like a server after a power outage?

Bitcoin is slow because it's universal. Its ten-minute blocks guarantee global propagation, equality between nodes, and absolute security. Its slowness is its robustness. Solana focuses on speed and user experience. Bitcoin focuses on immutability and censorship resistance.

Traders choose Solana for quick pump & dumps. People choose Bitcoin to save their savings.

The great illusion of “cryptos”

This is the heart of the problem: lumping everything together. Talking about “cryptos” as if Bitcoin and the others exist on the same scale. They have nothing in common. Bitcoin is a monetary protocol. The others are technology projects, stocks, utility tokens, experiments. One is fighting for individual sovereignty. The others are fighting for market share. One is a monetary standard. The others are companies with competitors. One will survive. The others will be replaced.

Most YouTubers celebrate the decline in Bitcoin dominance as if it were good news. As if seeing tokens artificially inflated were worth more than seeing an incorruptible monetary standard take root. But that's an illusion. Because when the tide goes out, we discover who's swimming naked. And with each cycle, altcoins evaporate, while Bitcoin emerges stronger.

Conclusion

Bitcoin is not a cryptocurrency. It is the only monetary invention of the digital age. Everything else is just a more or less shaky replica, a product of speculation, a centralized tool disguised as decentralization. When we understand this, we change our perspective. We no longer see a competition of projects, but a clear divide: on one side, Bitcoin, incorruptible, leaderless, masterless, uncompromising. On the other, companies that play with technology, making and unmaking the rules according to their interests. The choice is not between several cryptocurrencies. The choice is between illusion and truth. Between distraction and sovereignty. Between speculation and freedom.

There are no cryptos. There is only Bitcoin.

👉 Also read: