HALVING: WHAT IS IT???

Share

Halving: Why Bitcoin Becomes Rarer Every 4 Years

In the Bitcoin universe, an event comes around like clockwork every four years: the halving. A simple word, but one with far-reaching consequences. At each halving, the reward paid to miners for each validated block is halved. Why this mechanism? And more importantly, what does it really change for Bitcoin... and for you?

A rhythm programmed into the code

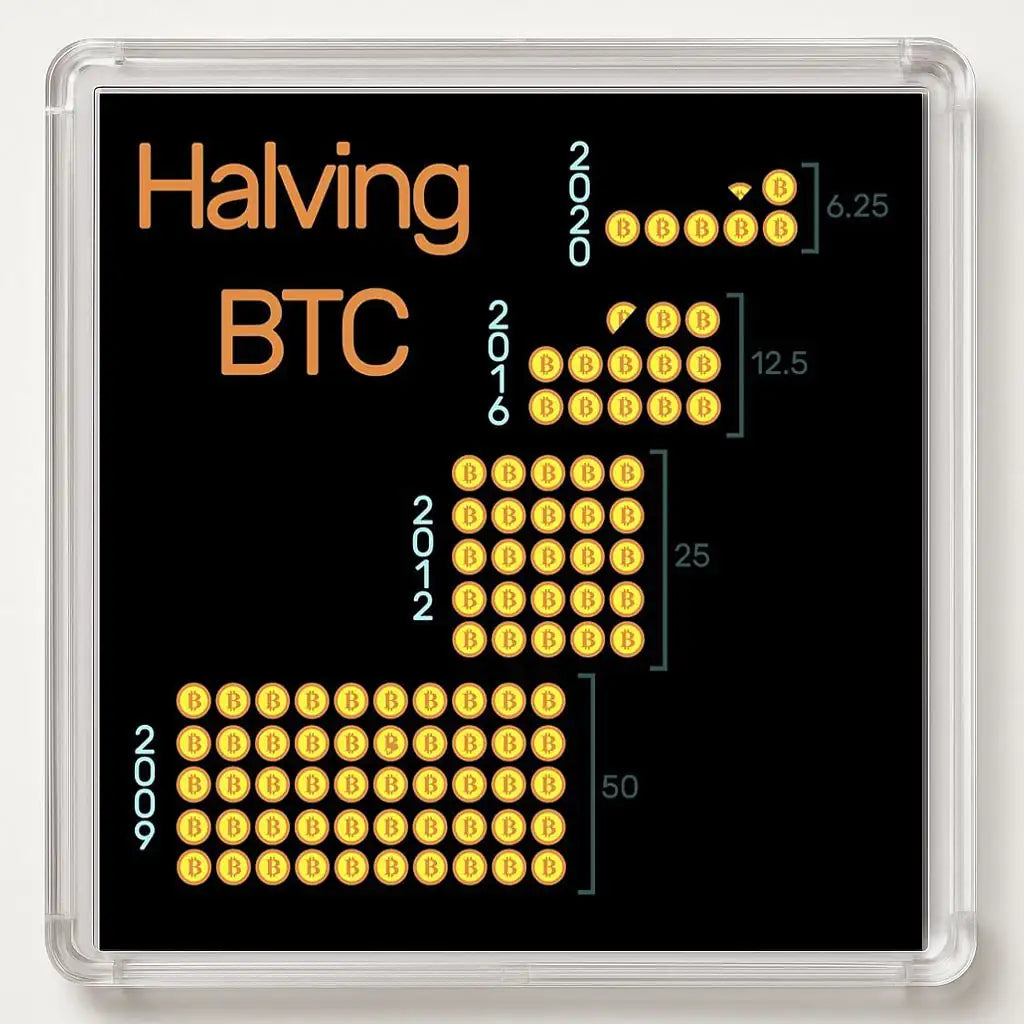

Since its creation by Satoshi Nakamoto in 2009, Bitcoin has been based on an open and immutable code. This code contains a rule: every 210,000 blocks, or approximately every 4 years, the miners' rewards are halved. This process has already occurred four times:

- 2009: 50 BTC per block

- 2012: 25 BTC

- 2016: 12.5 BTC

- 2020: 6.25 BTC

- 2024: 3.125 BTC

The next halving will take place in 2028, further reducing the reward to 1.5625 BTC.

A digital rarity set in stone

The halving isn't just a technical tweak. It's at the heart of what gives Bitcoin its value: its planned scarcity. Unlike fiat currencies, which can be printed endlessly, the issuance of new bitcoins slows down over time... until it stops completely around the year 2140.

Result ?

→ Less BTC in circulation every day.

→ Mechanical increase in rarity.

→ A dynamic that stimulates demand… especially if interest in Bitcoin grows in parallel.

Why the halving has the markets talking

Each halving is an anticipated, analyzed, and sometimes overestimated event. But it has always marked a before/after in the price of Bitcoin.

- In 2012, Bitcoin rose from $12 to over $1,000 within a year.

- In 2016, it exploded to $20,000.

- In 2020, it reached almost $69,000 in 2021.

- And in 2024? Time will tell if history repeats itself...

A reminder for newcomers

Halving is the antidote to inflation. It's a simple yet powerful mechanism that moves us away from arbitrary monetary policies and reminds us that in Bitcoin, scarcity is a promise kept.

So the next time you hear about “halving,” remember:

→ It's not just a technical event.

→ It is a political statement.

→ And perhaps this is the perfect time to look at Bitcoin differently.

Welcome to 100 Blocks.

👉 Read also :