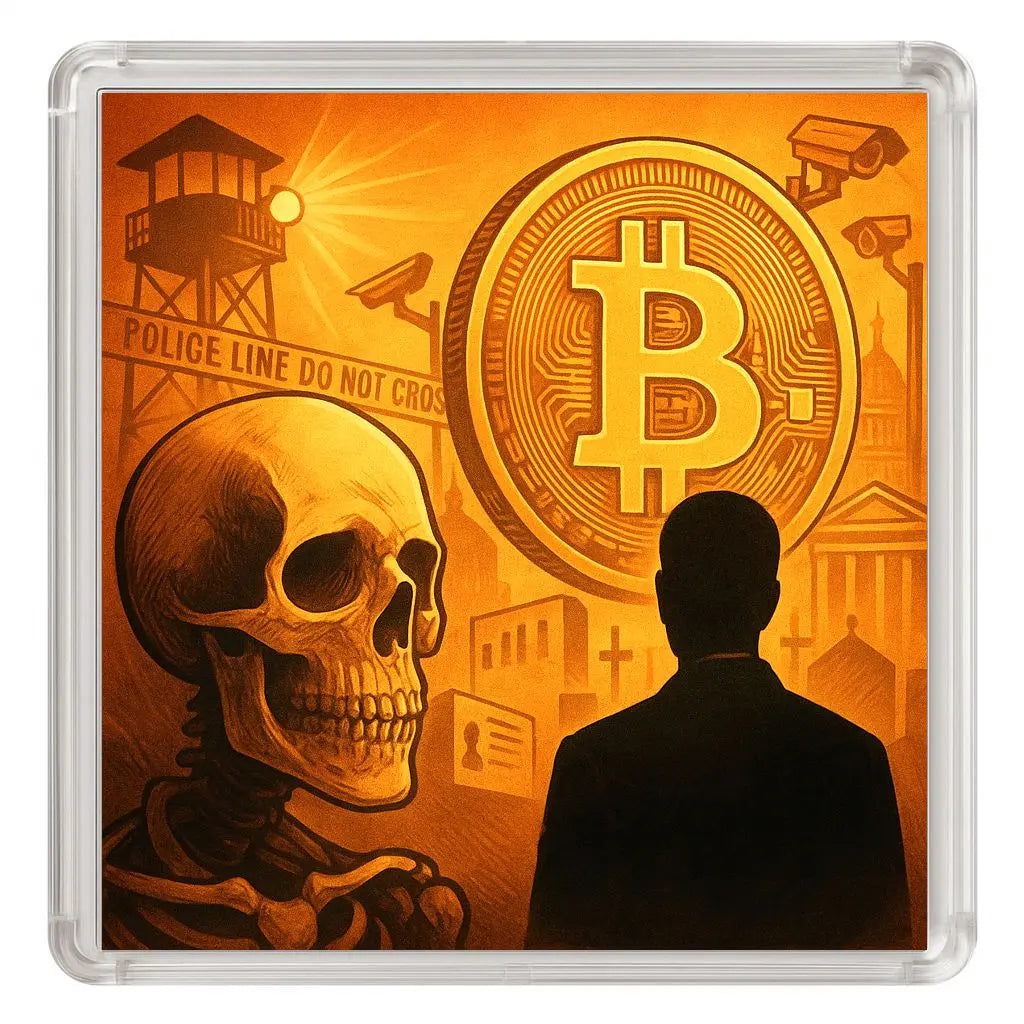

THE DAY THE STATE WANTS YOUR BITCOIN

Share

That day, there will be no explosions, no chaos, no shouting in the streets. It will begin with an email. A neutral, almost administrative message, written in that cold language that smacks of neither threat nor compassion. It will read that, in accordance with the new regulations, every citizen will have to declare their digital assets before the end of the year. A formality, some will say, a technical adjustment in the fight against money laundering and tax fraud. Most will see nothing coming. They will check the boxes, download the supporting documents, congratulate themselves on participating in the effort for transparency. They will not yet know that they have just signed the end of their sovereignty.

It will all start with harmless measures. Banks will refuse transfers to uncertified platforms, private wallets will be flagged as suspicious, and companies that don't comply with the new rules will lose their licenses. The media will talk about modernization, adapting to a safer digital world, balancing innovation and security. People will applaud. Servitude likes to disguise itself as progress. No one wants to see the trap when it's comfortable.

In ministerial offices, we will talk about public order, monetary stability, and the national interest. We will cite experts, we will invoke fear, always fear, that soft weapon that makes all tyranny reasonable. We will say that cryptocurrencies must be regulated to prevent abuse. And little by little, without anyone being upset, the line between protection and control will disappear. Citizens will learn to live with the idea that private property no longer really exists, that it now depends on their compliance. They will not understand that a property that must be declared is no longer a property, but a concession.

The first to be notified will be those who already own Bitcoin. They'll receive a message from their exchange: "Your account is temporarily suspended pending regulatory update." Their funds won't disappear; they'll simply be "held." An update to the contract, an adjustment to the terms of use—a fancy way of saying their freedom has become conditional. Some will protest, others will resign. The majority will choose the easy way out. You don't fight for what you don't understand.

The state doesn't need violence to confiscate. It needs paper, laws, and fear. It needs to transform disobedience into abnormality. It will say that those who refuse to submit are extremists, economic terrorists, enemies of transparency. And the others will acquiesce. They will look the other way, as always. Because modern man is not afraid of servitude; he is afraid of isolation. He prefers to be a slave among others than free in silence.

Governments have never tolerated zones of autonomy. Bitcoin is not a financial tool; it is a space of pure disobedience. A place without permission, without hierarchy, without a leader. It cannot be controlled, it cannot be understood. It cannot be directed, it must be verified. And that is precisely why it is disturbing. It is a stain on the map of power, a reminder that truth can exist without authority. It is proof that a code can be stronger than a law. It does not need a state, and this is what condemns it in the eyes of the state.

Then the government will do what it always does when it can't control: it will regulate to the point of suffocation. It will impose certified wallets, linked to a unique digital identity. It will prohibit anonymous transactions, then unauthorized transactions, then transactions at all. It will create official versions of Bitcoin, tame clones, compliant ersatz coins. Citizens will still believe they own them, but it will be an illusion, a shadow under fiscal and algorithmic control. Free money will become state currency, the tool of emancipation will be recycled into an instrument of surveillance.

The most lucid will sense the tide turning. They will understand that the battle is not won with words, but with backups. They will move their coins off platforms, generate their own addresses, install their nodes, engrave their keys on metal. They will do this not out of paranoia, but out of lucidity. They will not hide, they will disappear. Not from the world, but from the radar. Their presence will become invisible, their wealth untraceable, their freedom undetectable. They will have understood that in a digital world, disappearing is the purest form of resistance.

Meanwhile, others will continue to believe that everything is fine. They will console themselves with empty phrases: "I've declared everything, I have nothing to hide." They will call prudence what is nothing more than submission. They will talk about security, but they will confuse security with dependence. The State will take their data, their transactions, their preferences, and in exchange it will offer them comfort and loyalty points. They will live in a world of permissions, and they will find this normal. Their wealth will be counted, monitored, adjusted. They will no longer own anything, but they will have the feeling of being in compliance. And that is all that will be asked of them: to obey with a smile.

But there will come a time when the facade will crack. A financial crisis, a war, an energy shock, it doesn't matter. States will need money. And when a state needs money, it finds it. Always. In your accounts, in your pensions, in your pockets. This time, it will find it in your wallets. It will call it an exceptional measure, a citizen contribution. The same words that have been used for centuries to justify plunder. Those who believed that “it would never happen” will understand too late that every system always ends up feeding off those it protects.

The fiat world does not die suddenly. It crumbles by small steps, by successive compromises, by accumulated cowardice. Men get used to everything, even to injustice, provided it is gradual. They do not see that the danger lies not in total control, but in the slowness of control. This is how servitude becomes bearable: through gentle progression, through habit. And this is how freedom disappears, not in pain, but in consent.

In the face of this, Bitcoin stands firm. It offers neither forgiveness nor promises. It does not negotiate. It does not bend. It has no ministry, no representative, no point of weakness. It obeys only one law: that of consensus. As long as a single miner, somewhere in the world, validates a block, the system holds. As long as a single individual holds its private key, freedom still breathes. This is the brutal beauty of Bitcoin: it is indifferent to fear. It depends on no institution for survival, only on the will of human beings determined not to bend.

The sovereign Bitcoiner is not a revolutionary, he's a realist. He knows that institutions don't reform, they collapse. He knows that laws change, that regimes fall, but that mathematics doesn't lie. He doesn't seek to convince; he simply prepares. His revolt is silent, almost meditative. He learns, he configures, he secures. He acts quietly, without anger, because he understands that true resistance isn't shouted, it's practiced.

Those who don't understand still think Bitcoin is an investment. They look at the price, not the meaning. They speculate on value, not the truth. They believe they are buying an asset when in fact they are holding in their hands an instrument of liberation. They will treat it like a product and will be treated like customers. The others, those who know, use it as a tool of emancipation. They know that it is not enough to possess satoshis, you must be worthy of them.

When the state wants your Bitcoin, it will be too late to learn. You won't be able to improvise sovereignty. You won't find a tutorial for freedom. It is cultivated block by block, hash by hash, like a habit, like hygiene. Bitcoin is not a shelter against chaos, it is training in reality. It teaches you responsibility, patience, rigor. It promises you nothing, it tests you. It doesn't protect you from the state, it prepares you to live without it.

The day the decree is issued, some will panic. They will try to sell, transfer, or flee. They will discover that their regulated wallet has been deactivated, that their funds are “under review,” that their keys don’t belong to them. Others will remain calm. They won’t have to do anything. Their coins will already be elsewhere, out of reach, outside the visible network. Their wealth will exist outside the sphere of power. And the best part is, no one will know. Not even them, until the moment they need it.

It is at this precise moment that sovereignty will take on its full meaning. When the State can seize everything except what you have understood. When the entire world will be scanned, recorded, noted, and your freedom will be contained in twelve words engraved in metal. On that day, there will be no need for speeches, no need for a flag. There will be just the quiet silence of those who have chosen rigor over fear. They will be few in number, but they will have everything.

And somewhere, in a garage, a Bitaxe will purr. A tiny machine, alone, linked to infinity. Its lights will blink like heartbeats. It may never win a block, but it will keep trying. Because every hash is an act of faith, every watt spent a declaration of independence. The miner doesn't seek fortune, he seeks truth. He knows that freedom isn't claimed, it's calculated.

The day the state wants your Bitcoin, remember that it's happened a thousand times before. Regimes come and go, currencies die, empires crumble, but the truth endures. Bitcoin doesn't need a majority to survive; it needs to be fair. As long as a single human being, somewhere, refuses to delegate responsibility, the network will hold. And in this world saturated with lies, that simple fact will be enough to make the powerful tremble.

So when the time comes for the decree, don't argue. Don't protest. Close the browser window, unplug the cable, watch your node spin, feel the heat of your miner. And remember that freedom only dies when you stop practicing it. The state will want your Bitcoin, but it can never confiscate your lucidity. Because it's not written anywhere, except in your mind.

And as long as there remains a person capable of verifying a block, another capable of mining it, and yet another capable of transmitting it, Bitcoin will live on. Not as a currency, but as a memory. Not as an asset, but as an oath. Silent proof that truth, when shared, becomes eternal.

🔥 Also read: