BITCOIN AND GRESHAM'S LAW

Share

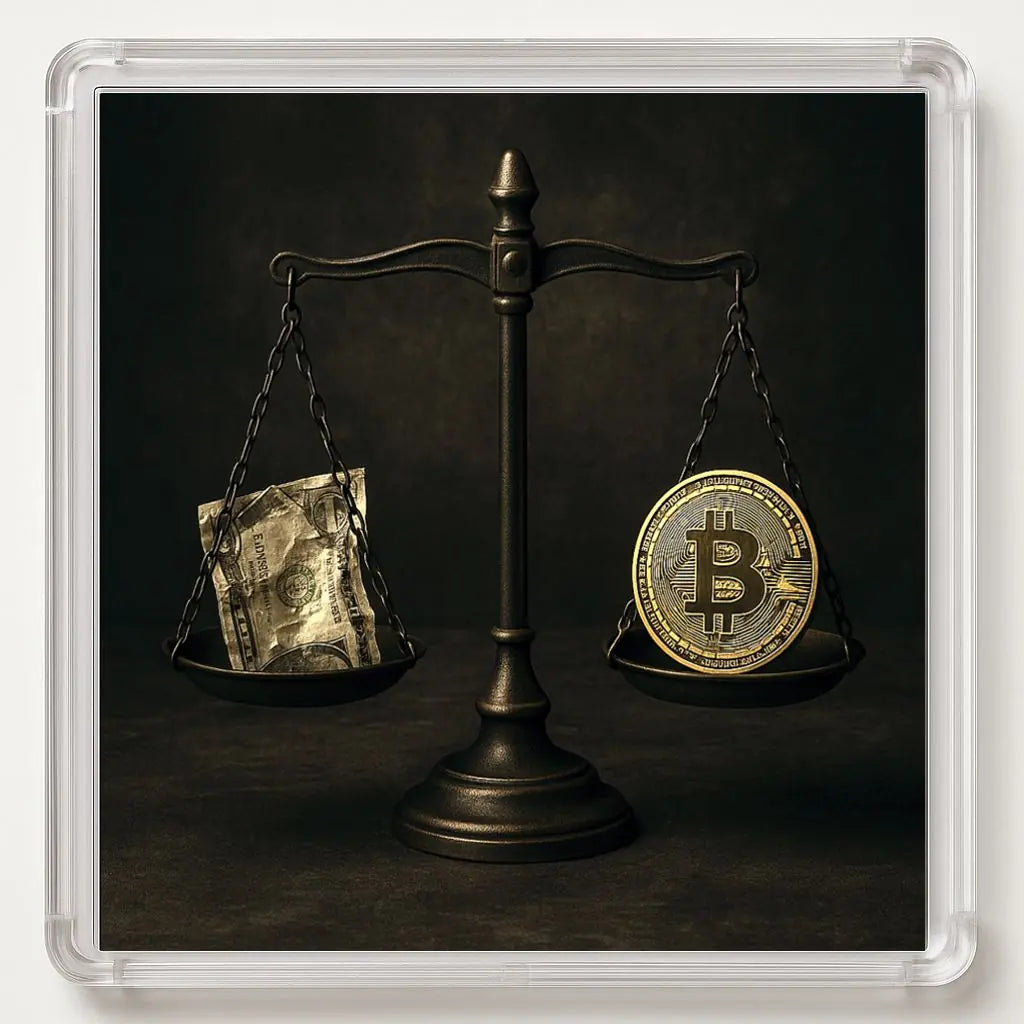

DOES BAD MONEY ALWAYS DRIVE OUT GOOD MONEY?

For centuries, Gresham's Law has intrigued economists and currency enthusiasts. Formulated in the 16th century by businessman and financier Thomas Gresham, it describes a simple but implacable mechanism: when two currencies with the same legal tender coexist, the one perceived as lesser in quality or more prone to devaluation will be preferred for payments, while the currency deemed more valuable will be hoarded. As a result, bad money invades the real economy, and good money disappears from trade. This principle has marked the monetary history of many countries, particularly during periods of repeated debasements of precious metal coins or periods of hyperinflation.

GRESHAM'S LAW THROUGH HISTORY

In the Roman Empire, under the reign of certain emperors, the silver content of coins decreased over time to finance wars or colossal projects. This gradual devaluation caused a loss of confidence and a collapse of the monetary system. More recently, in the 20th century, hyperinflation in Zimbabwe or Weimar Germany demonstrated the mechanics of Gresham's Law at the state level: the national currency lost its value every day, citizens spent their banknotes as quickly as possible, while they sought to hold onto any more stable form of value, such as gold or foreign currencies. These episodes remind us that the value of a currency depends less on the will of governments than on the collective trust it inspires. When trust disappears, flight to a better store of value becomes inevitable.

BITCOIN, A NEW “GOOD CURRENCY”

Bitcoin, with its limited supply of 21 million units and its immutable protocol, represents a profound disruption. Unlike fiat currencies that can be printed endlessly, Bitcoin promises absolute scarcity, engraved in the code. This characteristic makes it a "good money" according to many contemporary economists. The behavior of many BTC holders, who choose to hold it rather than spend it, illustrates what some call the "Bitcoin paradox": while it was designed as a payment system, it is primarily becoming a store of value. Bitcoins are leaving exchange platforms to be placed in offline wallets, reinforcing this dynamic. This behavior is often criticized by those who see Bitcoin as a tool for speculation rather than a currency. But it can also be interpreted as a sign of trust: when individuals believe that a currency will be more valuable tomorrow than today, they prefer to hold it.

TOWARDS A REVERSAL OF GRESHAM’S LAW?

If Bitcoin continues to gain adoption, could it one day reverse Gresham's Law? In this scenario, "good money" would drive out "bad" money: individuals would gradually abandon depreciating government currencies in favor of an asset whose issuance is known and predictable. This prospect remains uncertain, but it is attracting increasing attention as distrust of central banks and their monetary policies grows around the world. In some countries affected by currency crises, Bitcoin is no longer just a speculative asset but a genuine tool for economic survival. In Argentina, for example, faced with inflation of more than 200% over a year, many are choosing Bitcoin to protect their savings. This use reinforces the idea that sound money can naturally establish itself, even without a central authority, simply through the trust it inspires.

REWRITING THE RULES OF THE MONETARY GAME

Gresham's Law, as it had applied for centuries, relied on state coercion: the obligation to accept bad money as well as good. Bitcoin, as a decentralized currency, escapes this logic and gives individuals a choice they previously lacked. This opens up a novel possibility: that good money could once again become the standard, not by decree but through voluntary adoption. Reflecting on Gresham's Law in the age of Bitcoin means rethinking the very nature of money, the collective trust that gives it value, and the role of individuals in preserving their purchasing power. In a world where money printing has become the norm, Bitcoin offers a credible alternative for those seeking protection against the continued devaluation of fiat currencies. Ultimately, Gresham's Law applied to Bitcoin is not just another chapter in monetary history, but an invitation to understand why scarcity, trust, and the freedom to choose one's currency are at the heart of today's economic challenges. And perhaps the key to a future where good money is no longer hunted, but victorious.

👉 Also read:

- Satoshi Nakamoto is not a myth

- The halving: what is it?

- Why Bitcoin is a weapon against surveillance